Cryptocurrency tokens supply

Quick dive into cryptocurrency supply mechanisms, for your DApps or games

Recently I was explaining how stable coins like Tether worked and got asked this question:

How can a cryptocurrency have an unlimited supply? Isn't limited supply the whole point of cryptocurrencies?

While the answer is obvious for anybody familiar with the space, it is still a relevant question. And an excellent occasion to discuss the various supply mechanisms present in crypto!

Algorithmically limited supply

The creation of new coins is algorithmically limited by the blockchain software every node & miner runs.

- Coin supply can increase ➚

- Coin supply can decrease ➘ explicitly (burn mechanism builtin the protocol) or implicitly (send to burn address, lost private keys)

- Capped supply

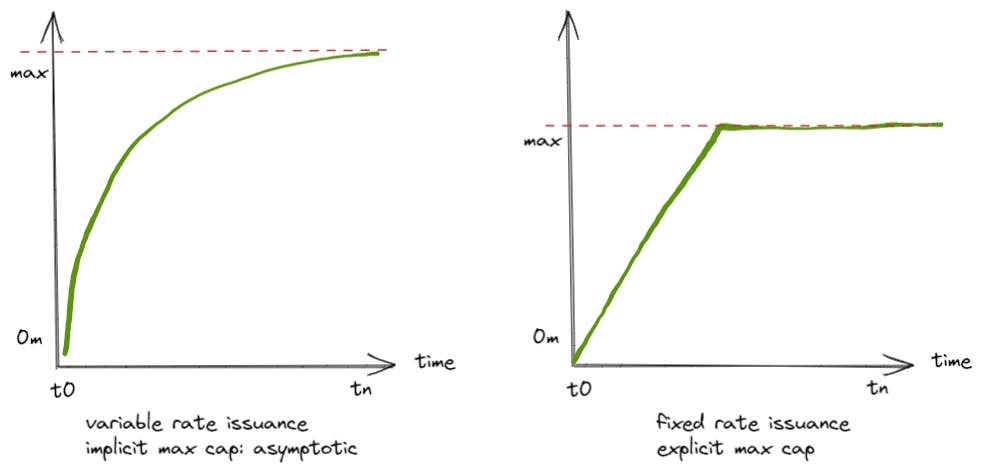

The maximum cap can be explicit, for example, "after the system created 10m coins, stop generating new coins" or implicit: "reduce coin issuance by x% every period, until it reaches 0".

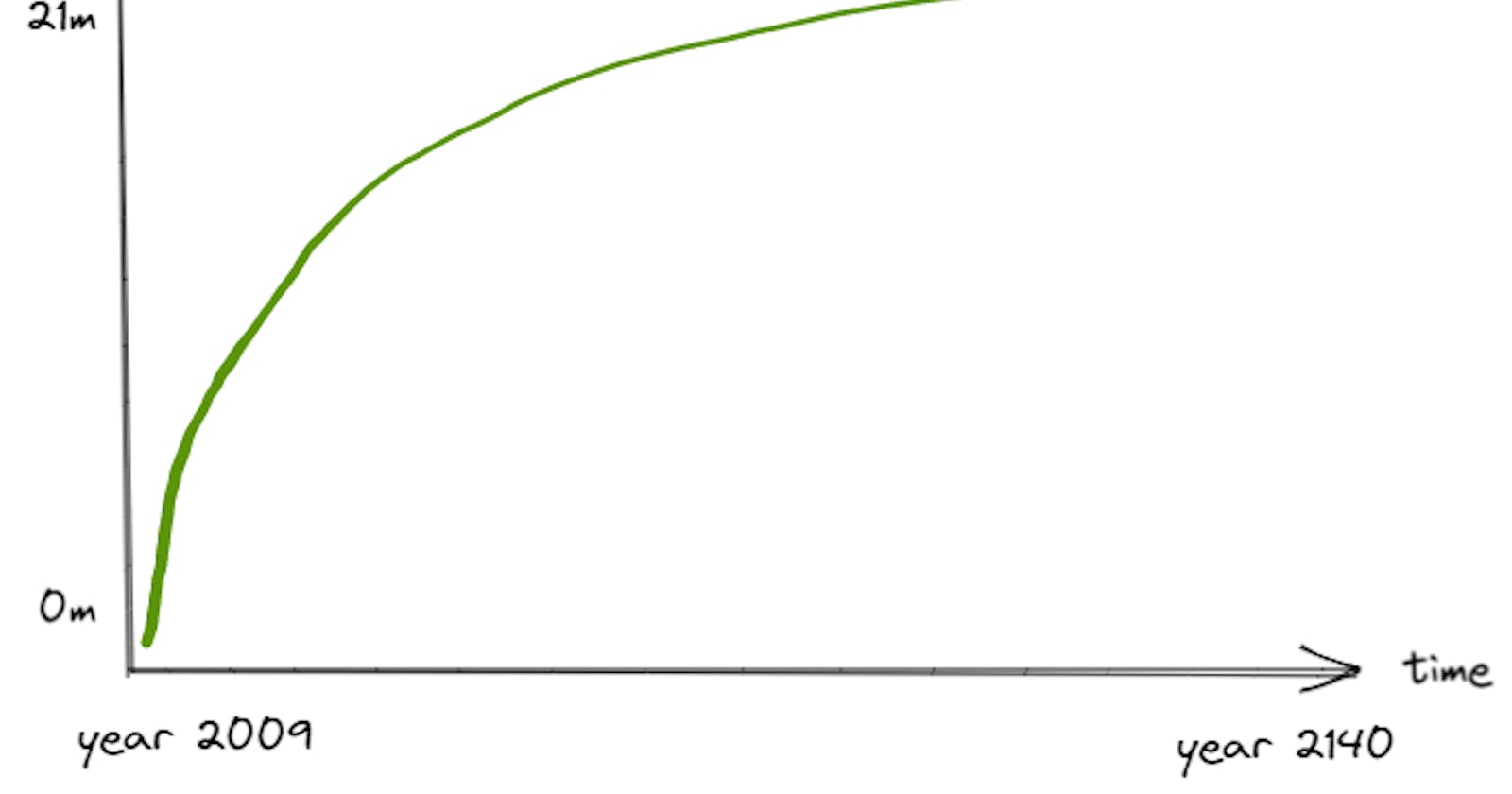

Example: Bitcoin has a max cap of ~21million coins. After a certain number of blocks, the amount of Bitcoins generated per block is halved. This process is repeated until no coins can be created anymore. After that, supply can implicitly decrease: using burn addresses.

Fixed supply

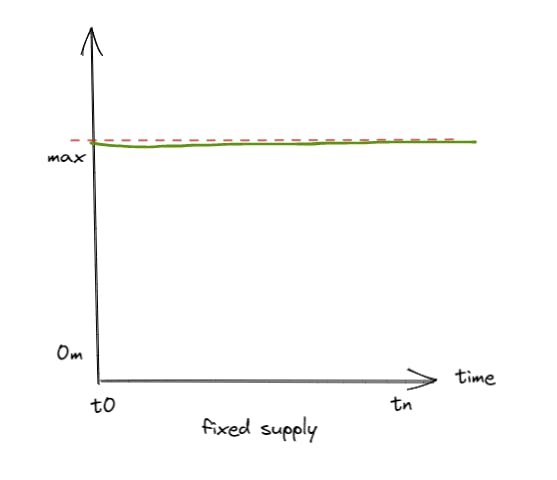

The maximum cap is explicit in the code. All coins are generated (minted) at the genesis of the blockchain or smart contract.

- Coin supply cannot increase ➚

- Coin supply can decrease ➘: builtin protocol or by burning tokens

- Capped supply

Example: A lot of ERC-20 tokens are working like described above. In the contract constructor, we can generate all the tokens that will ever be in existence. Then we can redistribute the tokens to various holders.

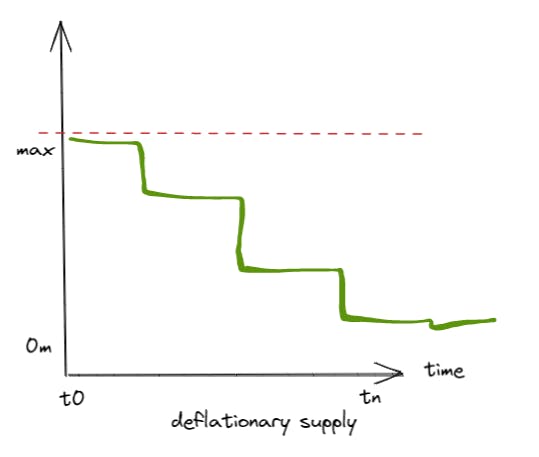

Deflationary supply

It is also possible to use the previous model of fixed supply and add a deflationary component. This mechanism explicitly decreases supply by destroying tokens. For example, a smart contract could destroy a small percentage of coins every time they are used.

- Coin supply cannot increase ➚

- Coin supply can decrease ➘: an essential part of the protocol

- Capped supply

Example: Some cryptocurrency exchanges have created tokens that they redistribute to users. A portion of these tokens is burned proportionally to the revenue made by the platform. This process reduces supply and increases token prices through scarcity.

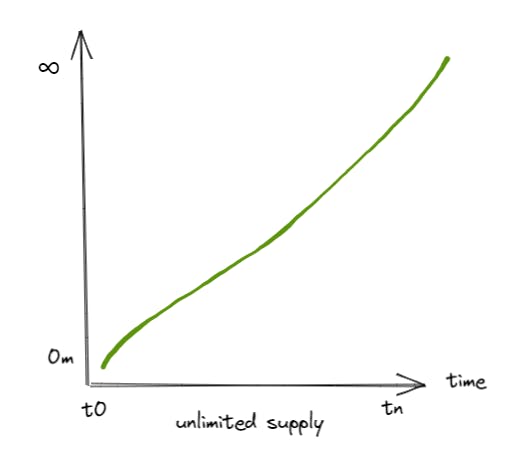

Unlimited supply

Supply can also be unlimited: there is no maximum cap on the number of tokens. This mechanism can be useful if the developer cannot predict how many tokens are needed in advance.

Example: Tether (and most stable coins) supply is not limited. Every time Tether receives 1 USD, they are allowed to create a new USDT. As long as people are willing to deposit more USD, the stable coin supply increases. Supply is reduced when USDT is redeemed (in practice, it rarely happens).

More

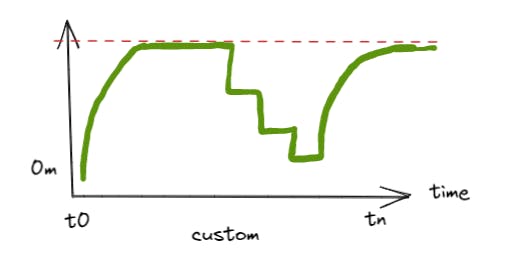

It is always possible to combine the various types of supply mechanisms to create your own. Especially when designing Play To Earn games, your economy design relies on multiple currencies and tokens. Why not let the users vote to adjust the monetary policy?

The possibilities are endless, as long as your design is fair for users!